I take the liberty to summarize an article titled “The Death Spiral” written by John Rubino.

Conventional wisdom tells us that governments with unlimited printing presses would spend and borrow too much, forcing their central banks to keep interest rates unnaturally low to make interest costs manageable, which would encourage even more credit growth and inflation to spike. And it will spiral this way until everyone loses faith in the fiat currencies and send these currencies to their intrinsic value of zero.

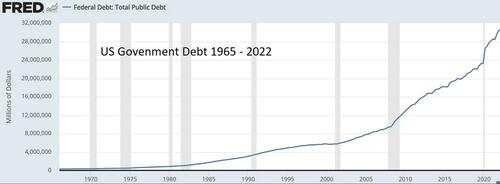

We can see that the national debt of US has gone exponential from the chart below, and you can extrapolate the curve to see the debt in another few years. Inflation has jumped by 10% in 2022 causing the central bank to raise interest rates to counter the inflation. The author and I opined that here is where the death spiral kicks in. (The sudden escalation part of the exponential curve is the critical phase to watch in any event. This is explained in Chapter 2 of my book, The Coming Economic Flood.)

In 2023, the annual interest cost bill will hit USD 1 trillion. Combined with the soaring cost of Medicare and Social Security, the US government is looking at USD 2 trillion just in interest and entitlements. The annual budget deficit already stands at USD 1 to 2 trillion. It will require even more borrowing and will spiral till it all comes crashing down.

This is the situation of a rock and a hard place the monetary authorities is facing. Either choice of keeping interest rates high or pushing them down leads to the same place of a currency crisis.

Is that how the wealth of Babylon is laid waste in one hour and the kings of the earth, merchants and those who make their living by the sea will weep together since all live in luxury with her and grow rich because of her ? Rev 18.